Another record year in Company’s financial performance

Consolidated Revenue reaching €1 billion euro, Earnings Before Interest and

Tax (EBIT) €139.8 million and Earnings After Tax €85 million euro

• Proposed dividend at 0.70 euros / share

Autohellas announces annual results for 2023, recording a new historical milestone for the Group, both in Consolidated Revenue, Operating Profit and Profit before Tax, for a third consecutive year.

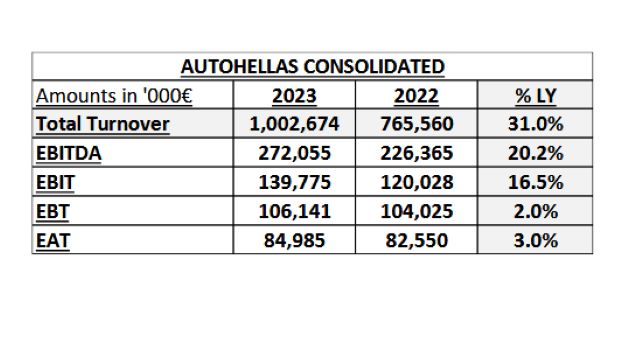

Specifically, the Group recorded an increase of 31% in Consolidated Revenue, which amounted to €1,002.7 million compared to €765.6 million in 2022, with Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) at €272.1 million, increased by 20.2%.

Specifically, the Group recorded an increase of 31% in Consolidated Revenue, which amounted to €1,002.7 million compared to €765.6 million in 2022, with Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) at €272.1 million, increased by 20.2%.

Operating Profit (EBIT) amounted to €139.8 million, compared to €120 million in prior year, an increase of 16.5%. Finally, earnings before tax reached €106 million, while Group’s Earnings after Taxes (EAT) reached €85 million, noting a 3% increase, as the significant increase in interest rates absorbed most of the growth in operating profitability.

It is noted that the activity of FCA Greece (FIAT/JEEP/ALFA Romeo), which was jointly acquired with SAMELET in May 2023 and renamed Italian Motion, is not included in the Consolidated Revenue (it is consolidated through equity method). However, it produced Sales of €174 million for the year 2023, further enhancing the overall activity and dynamics of the Group.

Based on the annual results, the Board of Directors will propose to the upcoming General Meeting a dividend of €0.70 per share for the fiscal year 2023.

Based on the annual results, the Board of Directors will propose to the upcoming General Meeting a dividend of €0.70 per share for the fiscal year 2023.

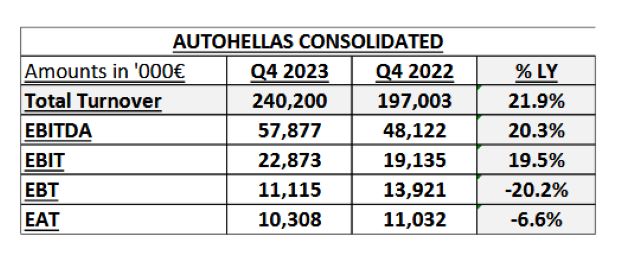

During the fourth quarter of the year 2023, the Consolidated Turnover increased by 21.9% and amounted to €240.2 million compared to €197 million during the fourth quarter of 2022.

Operating Profits (EBIT) amounted to €22.9 million, increased by 19.5% while Profits before Taxes (EBT) and Profits after Taxes (EAT) reached €11.1 million and €10.3 million respectively.

Breakdown by sector:

Rentals Greece

Turnover from car rental activity in Greece increased by 7% in 2023, reaching €268.4 million, but also 34.6% higher than in 2019. A significant contribution to the increase is made by long-term leases and mostly by the effective disposal of used fleet cars.

International Segment

The Turnover of the activity of the international subsidiaries related to the rentals sector reached a total of €174.2 million compared to €92.8 million in 2022. The new activity of Hertz in Portugal, the largest subsidiary of Autohellas abroad, contributed a total of €98.3 million in Turnover, positively affecting the overall increase in operating profitability. The rest of the group’s subsidiaries in the Balkans and Cyprus recorded organic growth of 9.3%.

During 2023, fleet employed for short-term and long-term rentals (Greece and abroad) exceeded 57,000 cars, with the year’s new car purchases exceeding 14,000 units.

Auto Trade Greece

The car trading activity in Greece, with the gradual restoration of production and the expansion of the Group’s brand portfolio, demonstrated a significant increase in the Import/Distribution segment. The cumulative market share of the Autohellas Group held by Hyundai, KIA, SEAT/CUPRA, FIAT, JEEP, ALFA ROMEO was 25% in private car sales, 17% in company car sales and 20% in total new car registrations in Greece. The activity contributed a total of €560.1 million to the Group Turnover with an increase of 32.7%, further contributing to the Group’s overall operating result, excluding the sales of Italian Motion (FIAT, JEEP, ALFA ROMEO), as it is consolidated through equity method.