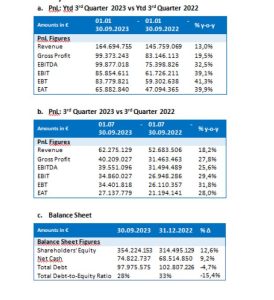

ANNOUNCEMENT – 3rd Quarter 2023 | Financial results

PPA SA announces the basic financial figures for the third quarter – nine months of the fiscal year 2023, which are based on data not audited by certified auditors – accountants, and the general developments in its activity:

2. Record operating performance with improved profit benchmarks

The Company continues its upward trend, achieving historically high-performance results that reflects the successful implementation of the plans of its Management.

The third quarter results continue the upward trend of the previous quarters, reinforcing the company’s continued business development:

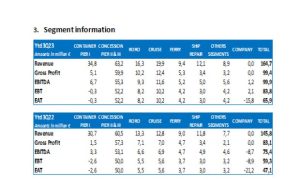

- Segment information

Revenues continued the upward trend of the previous period, with almost all of the company’s operating segments contributing to the increase. At the forefront of this growth are the Cruise, Container and Car terminals as well as the Ship Repair zone.

The improved results and benchmark margins reflect not only the improved revenue performance but also the effective cost management policy, which has kept them at a manageable level despite the continuing challenges of the energy crisis and the inflationary economic environment.

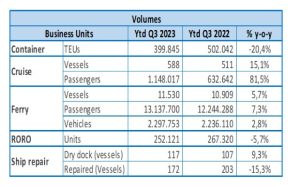

Organic growth

An increase in volumes compared to the same period 2022 was recorded in most PPA business units.

- Leader of this growth is the Cruise business, mainly affecting by the increase in the number of cruise ships homeporting at the port of Piraeus (arrival and departure of the ship from the same port) from 340 to 455 (+33,8%), while the increase of homeport cruise passengers is about 129,3% (from 378.899 to 627.017 passengers).

- Despite the decrease in total movements on Car terminal (Ro/Ro), it enjoyed a significant increase on local transshipment about 35,6% (from 88.299 to 119.735).

- At the Container Terminal, a 20.4% decrease in total traffic is recorded. The said decrease comes from the decrease in transshipment cargo handling 29,8% (from 386.945 to 271.787 TEUs), while it is partly counterbalanced by the slightly increase in domestic cargo by 11,3% (from 115.097 to 128.059 TEUs). This trend of domestic cargos in collaboration with the brand-new launched car shipment route and service project for car transportations from China to Europe, North Africa and Near East in 2023 are the reasons behind the total improvements under the container terminal business.

- Coastal shipping (Ferry) recorded significant increases following the positive trend of the Greek market

4.Significant changes in debt and/or capital structure and balance sheet figures

Not only does the company remain resilient to interest rate risks and unstable economic conditions, but it effectively uses its strong liquidity and the opportunities emerging in the Greek market by investing in short-term deposits, thus eliminating most of the risk it is exposed to and enabling the smooth implementation of its investment plan and its overall operations. The significant cash flow generation and the low debt-to-equity ratio indicate the company’s good health and stable development.

- The total bank borrowings of the Company are decreased in comparison to 31.12.2022, due to the repayment of 2 installments of the current loans (total repayments Eur 3,0 million)

- Cash & Cash equivalents balance clearly depicts the Company’s strong liquidity

- The investment activity of the Company continues based on its business plan and until the first quarter of 2023, investments carried out of Eur 15,6 million and Eur 14,3 million were made in the corresponding period of the previous year (31.12.2022: Eur 27.7 million).