- Improved operating performance with stronger benchmark margins

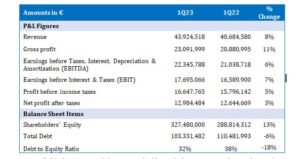

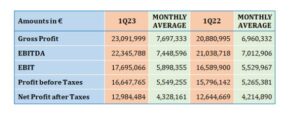

Revenue continued the upward trend of the previous period (+8%), with almost all of the company’s operating segments contributing to the increase. At the forefront of this growth are the Cruise (+146.5%), Container (+1.9%) and Car (+22.8%) terminals, as well as the ship repairing zone (+12.6%), rewarding management’s efforts to develop the business further.

The improved results and benchmark margins reflect not only the improved revenue performance but also the effective cost management policy implemented by the company’s management which keeps them at a well-managed level, despite the continuing challenges of the energy crisis and the inflationary economic environment.

- Significant changes in debt and/or capital structure and balance sheet figures during the first quarter of 2023.

The company remains resilient to interest rate risk and unstable economic conditions, enabling the smooth implementation of its huge investment plan and its overall operations. Despite the significant cash flow generation, the low debt-to-equity ratio indicates the company’s good health and stable development, keeping it at a low level of leverage.

The company remains resilient to interest rate risk and unstable economic conditions, enabling the smooth implementation of its huge investment plan and its overall operations. Despite the significant cash flow generation, the low debt-to-equity ratio indicates the company’s good health and stable development, keeping it at a low level of leverage.

- The total bank borrowings of the Company amounted to Euro 38.5 million on 31.03.2023, as well as on 31.12.2022, while it is significantly decreased in comparison to 31.03.2022 (Euro 44.5 million), due to the repayment of 4 installments of the current loans.

- Cash & cash equivalents amounted to Euro 153.7 million on 31.03.2023, compared to Euro 171.5 million on 31.12.2022, clearly depicted the Company’s strong liquidity (31.03.2022: Euro 135.1 million).

- In addition, the investment activity of the Company continues based on its business plan and until the first quarter of 2023, investments carried out of Euro 1.9 million and 4.2 million were made in the corresponding period of the previous year (31.12.2022: Euro 27.7 million).

- 3month 2023 major events

An increase in volumes compared to 2022 was recorded in most PPA business units. Especially in the Cruise sector which suffered the greatest impact from the pandemic, the number of cruise ships that visited in the first quarter of 2023 is increased by 61.5% compared to the first quarter of 2022 (21 against 13). A 573.0% increase in cruise passengers compared to 2022 (36,589 passengers compared to 5,437 in 2022) is recorded. Compared to the same period in 2019 which was the pre-pandemic year of full cruise operation a 75.0% increase in ship calls and a 65.7% increase in passengers is recorded in Q1 2023. Coastal shipping in the 1st Quarter recorded a 21.2% increase in passenger traffic (from 2.1 million to 2.5 million) and a 12.5% increase in vehicle traffic (from 502,381 to 565,009) compared to the same period of 2022.

An increase in volumes compared to 2022 was recorded in most PPA business units. Especially in the Cruise sector which suffered the greatest impact from the pandemic, the number of cruise ships that visited in the first quarter of 2023 is increased by 61.5% compared to the first quarter of 2022 (21 against 13). A 573.0% increase in cruise passengers compared to 2022 (36,589 passengers compared to 5,437 in 2022) is recorded. Compared to the same period in 2019 which was the pre-pandemic year of full cruise operation a 75.0% increase in ship calls and a 65.7% increase in passengers is recorded in Q1 2023. Coastal shipping in the 1st Quarter recorded a 21.2% increase in passenger traffic (from 2.1 million to 2.5 million) and a 12.5% increase in vehicle traffic (from 502,381 to 565,009) compared to the same period of 2022.

In the same three-month period the Car Terminal recorded a 9.4% decrease (from 98,169 to 88,953) in total cargo mainly due to continued disruptions to production chains despite a 69.1% increase in domestic cargo as transhipment cargo recorded a 36.4% decrease. At the Container Terminal, a 20.1% decrease in total traffic is recorded (from 166,949 to 133,425 TEUs). The said decrease comes mainly from the decrease 27.8% in domestic cargo handling (from 45,825 to 33,078 TEUs) and secondarily from a decrease in transhipment cargo by 17.2% (from 121,124 to 100,347 TEUs).

In the shipbuilding and repair sector, serviced vessels in the drydocks recorded an increase of 21.2% (from 33 to 40) in the 1st quarter compared to 2022, while vessels in the SRZ remained unchanged (64 vessels in both 2023 and 2022).